The B2B landscape has been dramatically reshaped by the Covid-19 pandemic. While digitalisation across the sector was undeniably advancing before the pandemic, the onset of Covid-19 brought about an explosion of online buying activity as brick and mortar stores closed, and other traditional offline and face-to-face sales outlets became non-viable, for reasons of safety.

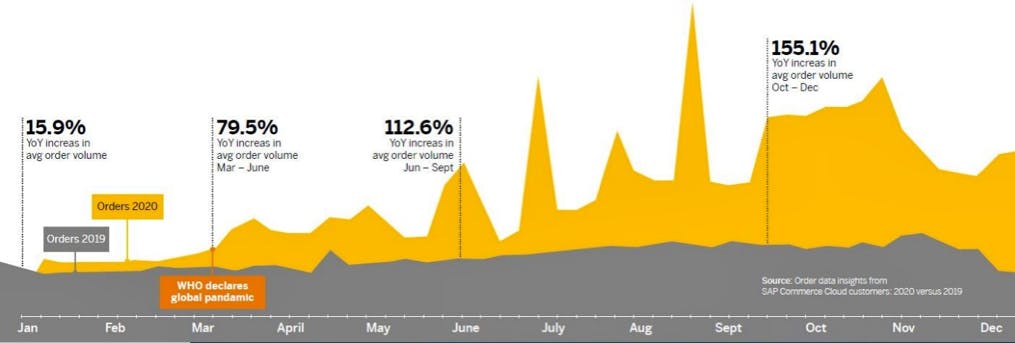

Figures captured by customer experience solutions provider SAP in 2020, published in the report ‘CX Insights: B2B Commerce’, illustrate the extent to which online commerce took off in B2B during the pandemic – and the lasting impact this has had. In January 2020, average order volume from the SAP Commerce Cloud customer base of B2B organisations was up 15.9% year on year (YoY) compared with the same period in 2019. By March-June 2020, this had shot up to 79.5%.

The summer saw even greater increases: average B2B order volume on SAP Commerce Cloud was up 112.6% YoY between June and September 2020, with some particularly astronomical peaks seen in late June and mid-August. Finally, in October to December 2020, average order volume was up 155.1% YoY on the same period in 2019, showing that far from tailing off, online B2B buying activity has only gained momentum.

This rapid and wholesale adoption of ecommerce has significantly altered the way that B2B buyers and sellers interact, bringing both challenge and opportunity. Above all, the changing landscape has shown the need for B2B organisations to deliver an outstanding customer experience.

In this article, we’ll examine three trends in B2B commerce, emerging from this transformation, that demonstrate the need for a new approach to customer experience.

B2B selling has moved from “push” to “pull”

B2B sales cycles and purchasing have historically been more “push” than “pull” on the part of B2B sellers, with sellers proactively pitching to clients via calls and trade shows, and purchases typically requiring the help of a company representative to carry out.

‘Self-serve’ buying experiences that could be completed entirely at the client’s convenience were becoming more commonplace in the years prior to Covid-19, but the B2B sector still lacked the critical mass of demand that would drive it towards implementing self-serve as default. However, that critical mass is exactly what we have been seeing in the wake of the pandemic, as illustrated so starkly by the figures above.

This means that sellers need to adapt to the new “pull” dynamic of B2B in which buyers will expect to be able to complete purchases any time, anywhere, and to have all of the information that they need to research and make a decision at their fingertips. Relevant, up-to-date product and solution information should be available at every stage of the buying cycle, and the friction in completing a purchase should be reduced as much as humanly possible.

B2B buyers have come to expect a convenient, personalised and above all straightforward purchasing experience – we’ll talk more about simplifying that buying experience in the next section – and will take their business elsewhere if they can’t obtain it. The internet makes the relative merits and drawbacks of each solution and its purchase journey readily apparent, and so B2B organisations can either stand out among the competition by meeting these customer expectations, or risk losing customers to competitors who are able to meet them.

Buyers expect a simplified purchase experience

Buyers’ expectations for the smoothness and simplicity of a B2B purchasing experience have been raised by corresponding B2C customer experiences, the bar for which was also raised during Covid-19 as customers demanded frictionless digital experiences. It pays to remember that B2B buyers are also B2C consumers in every other aspect of their lives, and so are increasingly holding their B2B purchases to the same standard. Why can’t B2B buying be as easy as a B2C purchase?

This expectation will remain in place no matter the complexity of the product or service being offered, and so it is up to B2B companies to devise ways of making that buying experience simple for the end customer. Self-service customer tools for intelligent merchandising can simplify product configuration, bundling and pricing, as can the right configure, price and quote (CPQ) solutions. An effective CPQ solution can also help to maximise revenue by eliminating over-discounting on deals, and surfacing upsell and cross-sell opportunities.

The use of tools like live chat and AI agents (such as chatbots) can also aid with this: the former by allowing customers to access specialist support and advice in real-time as they carry out their purchase, and the latter by offering automated help and/or segmenting out customers who are looking for technical support from those who need assistance with a purchase, as Hubspot has done with its chatbot solution.

In the first episode of the Marketing That Matters podcast, created by Marketing Week and Econsultancy, TalkTalk Commercial Sales Director Becki Smith spoke about how TalkTalk navigated these challenges during the onset of the Covid-19 pandemic and worked to simplify the purchase experience for a complex product offering.

“Our product isn’t that easy to understand,” she explained. “So, we knew that we had to really improve that user journey and user experience overall … We focused on making sure that our products and services were as easy to understand as possible.

“We had to make sure that our customers were at the heart of our approach, and that they absolutely could understand what product and service was right for them.”

B2B marketplaces increasingly form part of the customer journey

The Covid-19 pandemic brought about a steep increase in buyers’ use of B2B marketplaces, particularly in the early stages when existing supplier relationships fell through and companies scrambled to quickly source products.

Research carried out by Digital Commerce 360 B2B in July 2020 found that 89% of purchasing managers were buying at least the same amount, or significantly more, on B2B marketplaces as a result of circumstances brought about by Covid-19. At the same time, 57% said that they were spending more money on B2B marketplaces, with 22% reporting spending “significantly” more. As a testament to this, Amazon Business, one of the most-used generalist B2B marketplaces, reached $25 billion in worldwide annualised sales in March.

However, Amazon Business is far from the only game in town when it comes to B2B marketplaces: scores of vertical-specific B2B marketplaces exist to serve every possible need, from wheels and tyres to DIY equipment. Many commentators believe that B2B marketplaces are a huge potential growth area, representing in the words of Julia Morrongiello at Point Nine Capital, “a massive untapped opportunity” – and these statistics only reinforce that idea.

B2B sellers can ensure they don’t miss out on this trend either by listing on relevant marketplaces, or by starting their own. Partnering with an external provider to launch a B2B marketplace can serve to expand the business vertically, deepen customer and channel relationships, and drive enterprise growth, all while enabling organisations to gain valuable customer insights and maintain control of the end-to-end experience.

B2B buyers have taken to marketplaces due to the convenience and choice that they offer, and they increasingly form part of the customer journey as consumers use marketplaces to conduct research and compare product options to solve a specific need before searching for a retailer. Organisations who capitalise on this trend will ensure that they are present at every stage of the buyer’s journey as B2B marketplaces proliferate and thrive.

The future of B2B is overwhelmingly online

Omnichannel selling clearly has its complexities in B2B. A survey by McKinsey found that 68% of B2B decision makers say their sales team has experienced more channel conflicts as a result of an increase in sales being split across channels.

However, navigating these conflicts is a must when faced with the overwhelming evidence that customers do indeed want to do business online.

Further 2020 survey results by McKinsey found that only a month into the pandemic, more than 90% of B2B companies had shifted to a virtual sales model, and that given the choice, 70-80% of B2B decision-makers prefer remote human interactions or digital self-service to face-to-face with sales reps. In August 2020, 89% of respondents in the study said the likelihood of sustaining their new go-to market models for the next 12+ months was ‘somewhat’ or ‘very likely’.

The barriers are coming down and B2B is set to be a crucible of innovation in ecommerce over the next decade.

Comments