Indonesia also has a population ‘pyramid’ which gets B2C marketers excited. More than half of its population is under 30 and the country has a rapidly growing middle class.

Indonesians are also heavy mobile internet users. A Google Consumer Barometer survey found that 81% of Indonesians most often use a smartphone to access the internet, with only 3% preferring the desktop. A recent report by iPrice supports this, indicating that 87% of shopping is done on a mobile device in the country.

So, with such fertile ground for omnichannel marketing, are marketers in the country taking advantage of the opportunity? To find out, Econsultancy, in association with Resulticks, surveyed client-side marketers in Southeast Asia, including many from Indonesia.

The resulting report, The Omnichannel Imperative, is now available for everyone to download. Summary points regarding the responses from Indonesian marketers are presented below.

1) Almost all Indonesian marketers are prioritizing real-time marketing

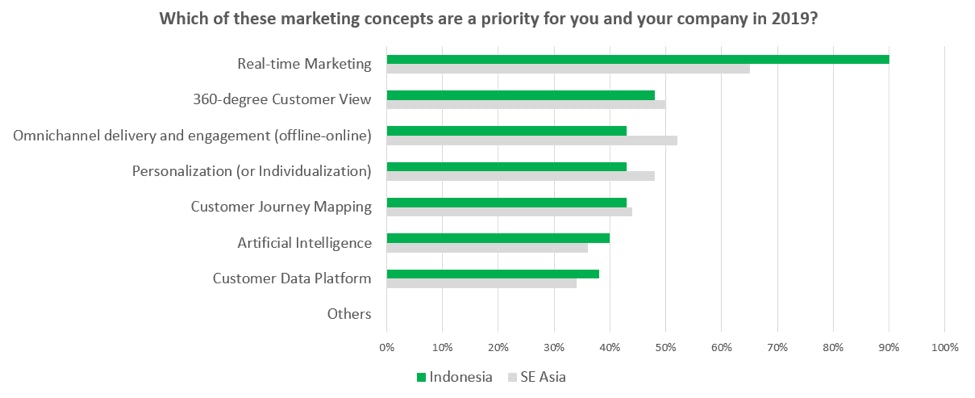

The first thing that jumps out about Indonesian marketers is how enthusiastic they are about one of the key components of omnichannel marketing.

When asked ‘which…marketing concepts are a priority for you and your company in 2019’, 9 out of 10 respondents from Indonesia selected ‘Real-time marketing’. This compares with 65% of the region overall and reflects that Indonesian marketers realize how important acting in real-time is for its mobile-obsessed consumers.

2) Marketers in Indonesia are less likely than others in the region to have well-integrated martech

Respondents were then asked whether they felt that their company ‘[takes] an integrated approach to customer engagement across different channels, leveraging 1st, 2nd and 3rd party customer data, with technology and processes to support this.’

While 54% either somewhat or strongly agreed with this statement, this percentage was much lower than responses from the region overall (70%) and especially from Singapore (84%). Accordingly, many more Indonesians disagreed that they had an ‘integrated approach’ (29%) than the average across Southeast Asia (18%) and marketers in Singapore (5% disagreeing).

So, while the enthusiasm for omnichannel is high in Indonesia, its marketers seem to be saying that they are not quite where they want to be regarding data and marketing technology.

3) Indonesian marketers are hungry for scalable solutions

When asked to rate their current vendors on the ‘ability of [their] platform to scale’, 45% of respondents from Indonesia indicated that their current platform was ‘poor’. This compares with 19% of the region overall and a mere 10% in Vietnam.

From the chart though, it’s quite clear that marketers were quite negative overall when their answers are compared with others in the region.

It’s possible that because Indonesia has such a large population which is ready for omnichannel that marketers are hitting issues with marketing technology early – and others in Southeast Asia, with smaller audiences, have yet to reach the limits of their current solution.

4) Managing data is the biggest obstacle marketers in Indonesia face in rolling out omnichannel

Finally, marketers were asked to select the ‘…main challenges that prevent you from carrying out effective and consistent omnichannel marketing across different channels.’

The three most-frequently selected obstacles by Indonesian marketers concerned data:

- Incomplete customer data across channels (50%)

- Poor data integration across systems / manual processes (48%)

- Too much data to manage (45%)

All these responses were considerably higher than the regional averages of 35%, 38% and 39% respectively.

From one perspective, this result may just be that marketers in Indonesia are more sensitive to the problems that all marketers in the region face.

But a more likely explanation is that, as pointed out in 3) above, marketers in Indonesia are more likely to be trying to deliver omnichannel at scale and so they are running into data and technology limits early.

With 270 million people to serve, it’s almost certain that omnichannel will remain a greater challenge in Indonesia than elsewhere. Marketers in other, less populous countries should, however, take note of the frustrations faced by practitioners in Indonesia as they are likely to be the problems that they will face in the future as their omnichannel marketing programmes grow.

Comments